Accounting for Joint Stock Company

Accounting for Joint Stock Company

Authors:

ISBN:

Rs.225.00

- DESCRIPTION

- INDEX

It is rightly said that “change is the only permanent thing in this world.” Any

change in the curriculum is therefore a natural step in the process of academic and

intellectual growth. Advancement in knowledge is possible only when subjects

are taught and learned in new ways, in keeping with the needs of changing times.

In view of the adoption of the New Education Policy (NEP) syllabus for

B.Com. Part–II (Semester–III) by Sant Gadgebaba Amravati University, it

becomes our responsibility to provide students with suitable and comprehensive

learning material. It is with great pleasure that we present this textbook on

Accounting for Joint Stock Company for the students of B.Com. Part–II

(Semester–III).

The book has been prepared in a self-learning style, strictly following a

student-friendly approach. Every effort has been made to present sufficient

theoretical explanations in simple english language supported with essential

short and long illustrations with solution, so as to cover all the important aspects

of the subject. The topics are arranged systematically, in exact accordance with

the revised syllabus.

This work would not have been possible without the constant support,

encouragement, and inspiration of our family members, to whom we owe a

deep sense of gratitude. We also express our heartfelt thanks to our esteemed

colleagues, whose constructive suggestions and critical feedback have immensely

contributed to the quality of this book.

We are particularly grateful to Prashant Publications, Shri Rangrao Patil, and

his dedicated team for their cooperation and assistance in bringing out this book

in time. Our sincere thanks are also due to Mr. Sunil Pandhare, the typesetter, for

his valuable contribution in the production process.

We sincerely hope that this textbook will prove useful to the students and

teachers alike. We warmly welcome valuable suggestions and constructive

feedback from readers, which will help us in making future editions more

comprehensive and effective.

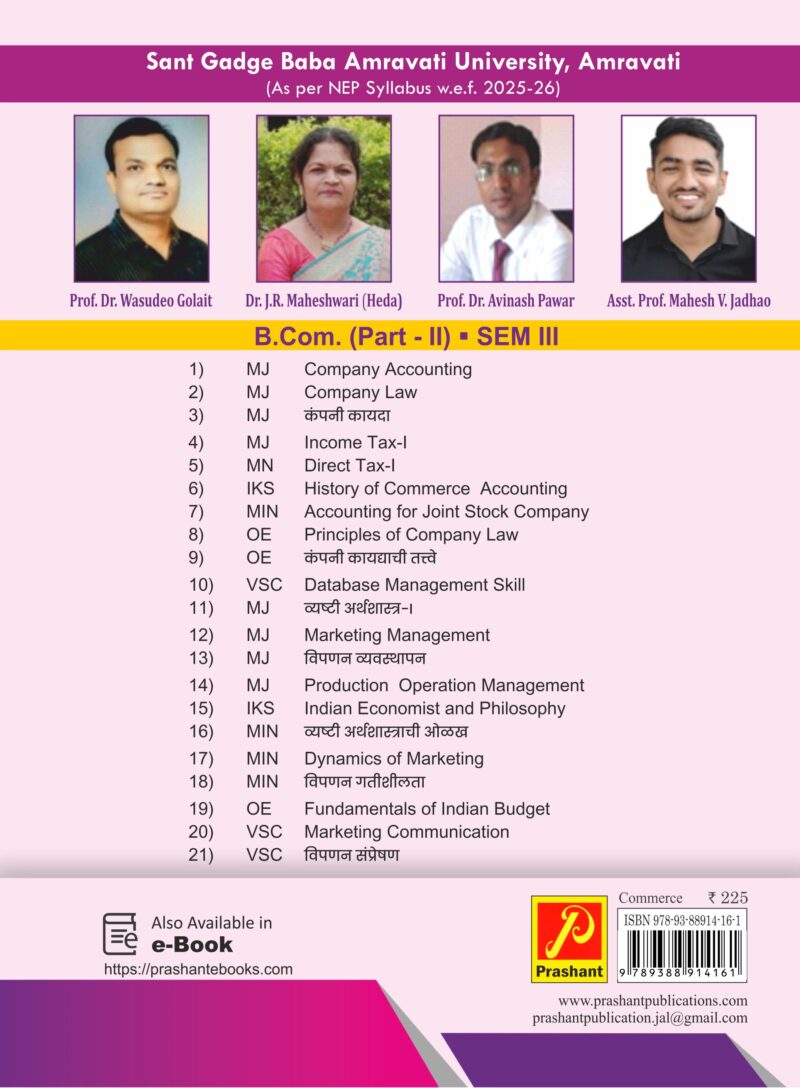

Unit 1 : Issue, Forfeiture and Re-issue of Equity Share, Issue of Debentures………… 7

1.1 Share: Meaning of Shares

1.2 Characteristics of Shares

1.3 Issue, Forfeiture and Re-issue of Equity Share

1.4 Practical problems of Equity Share

1.5 Debentures: Definition

1.6 Kinds of Debenture

1.7 Issue of Debenture

1.8 Practical problems

Unit 2 : Valuation of Goodwill………………………………………………………………………….. 53

2.1 The Meaning of Valuation of Goodwill

2.2 Characteristics of Valuation of Goodwill

2.3 Need of Valuation of Goodwill

2.4 Methods for Valuation of Goodwill

2.5 Problems on:

I. Average Profit Method

II. Super Profit Method

III. Capitalization Method

Unit 3 : Valuation of Shares……………………………………………………………………………… 79

3.1 Meaning of Valuation of Shares

3.2 Characteristics of Shares

3.3 Need for valuation of Shares

3.4 Methods of Valuation of Shares & Simple Problems on:

I. Net Asset Method

II. Yield Method

III. Fair Value Method

Unit 4 : Final Accounts and Financial Statement of Company

(Schedule III Part I & II) As per Company Act 2013……………………………….112

4.1 Introduction

4.2 Schedule III of Companies Act, 2013

4.3 Books of Account etc. to be kept by Company (Section 128)

4.4 Financial Statement

4.5 Format of Balance Sheet as per the Schedule III Company Act- 2013

4.6 Profit & Loss Statement – Part II of Schedule III

4.7 Explanation of each item of Profit & Loss Account:

4.8 Illustrations on Balance Sheet of Company as per Company Act

Schedule III Part-I

4.9 Illustrations on Profit & Loss Account of Company as per Company Act

Schedule III Part-II

Author

Related products

कंपनी कायद्याची मुलतत्वे

Rs.270.00कंपनी कायदा

Rs.270.00Introduction to Accounting

Rs.110.00Internet and World Wide Web

Rs.195.00